Why trading options NOW is the best strategy

Crypto has already experienced significant upside, and with the uncertainty of when Bitcoin’s bull run might come to an end, managing your risk is more crucial than ever. Options trading is an excellent strategy to help you do just that.

In my previous post, I showed you how we traded Solana with options, risking $229 for a potential gain of $1171. It was all about managing risk, understanding opportunity cost, and learning how to secure good profits while using options strategically. In today’s blog, we’re building on that foundation with an exciting update—and an opportunity to trade live with the captain himself, Kyle.

Kyle Goes Live: Don’t Miss This!

This Saturday, Kyle will go live on our YouTube channel to walk you through his plan to turn $229 into $1171, step-by-step. This isn’t just theory—Kyle will be trading in real time, giving you a firsthand look at how the pros in the Whale Room manage options trades to maximize gains and limit risk.

If you’ve ever wondered how to execute options strategies like a pro, this is your chance to see it in action.

To join in, make sure you’re fully prepped:

To jump in on the action, make sure you’re all set with these quick steps:

Sign up on Deribit if you haven’t already.

Join Kyle’s BANTER WHALE team for Deribit’s Winter Trading Competition 2024—there’s a juicy prize pool of up to 200,000 USDC on the line!

Connect to the Deribit API to SignalPlus, and you’re good to go.

In this blog, I’ll focus solely on the differences between buying call options, selling call options, and the powerful strategy of combining the two. You’ll learn how to minimize your risk while still positioning yourself for a great outcome in your trades.

Bull Call Spread: Planning a Fleet of Bikes for a Big Event

Imagine a big city marathon is happening next week, and you want to profit by renting out a fleet of bikes. You anticipate prices will rise due to demand but want to manage your costs and risks.

Buying Calls (Reserving Multiple Bikes at a Discounted Price)

You make a deal with a supplier to reserve 10 bikes at $300 each for a week by paying a $50 premium per bike upfront. This gives you the right to buy them at $300, regardless of how high prices go.

Selling Calls (Offering to Sell the Bikes at a Higher Price)

To reduce your costs, you sell 10 options to another rental company. For $20 per bike, they get the right to buy the bikes from you at $400 each if prices rise that high.

Buying a Call Option

Buying a Call: Reserving Bikes for a Future Profit

You’re convinced that the upcoming city marathon will lead to a spike in bike rental prices. To capitalize on this opportunity, you decide to buy a call option.

Here’s the deal: you pay $50 per bike to reserve the right to buy 10 bikes at $300 (strike price) each within the next week. Why? Because if bike prices go up, you’ll lock in a great price and profit from renting or reselling them. This way, you’re not committing to buying the bikes right now but keeping the option open.

Think of it this way: if bike prices shoot up to $450 or even $600, you’ll still be able to buy them at the much lower price of $300, making a tidy profit. On the flip side, if prices stay below $300, you can simply walk away. The only downside is the $50 premium you pay per bike, which is your maximum risk.

So, let us look at the chart below. The first thing you want to do is to break even with your initial cost. The moment you make this deal, you are at a loss of $500 for the options you paid for. So, you want the prices of the bikes to rise by $50 each to break even. That is, you want the price per bike to rise to $350 to break even. This is what is illustrated in the chart below.

But you can also see that if the price of the bikes drops, you are still only at a loss of $500. And this is what makes options such a great strategy. You will never lose more than the premium that you paid. But you have unlimited upside. Once the price of a bike rises to $350 you are at breakeven (that is 0 on the chart) and then from there on you are in profit for any upside that the prices still have. In summary, let’s have a look at the risk and reward.

Risk and Reward

Your risk is capped: The most you could lose is the premium you paid—$500 total for 10 bikes if you paid $50 per bike.

Your potential reward is unlimited: If prices skyrocket, your profit grows with every dollar above $300 (minus the premium). For example:

If the price of a bike goes to $450: Profit = (Price – Strike - Premium) = ($450 - $300 - $50) × 10 = $1,000.

If the price of a bike goes to $600: Profit = (Price – Strike - Premium) = ($600 - $300 - $50) × 10 = $2,500.

This is a great strategy if you’re bullish on the market. You’re essentially betting on a price rise while keeping your losses limited.

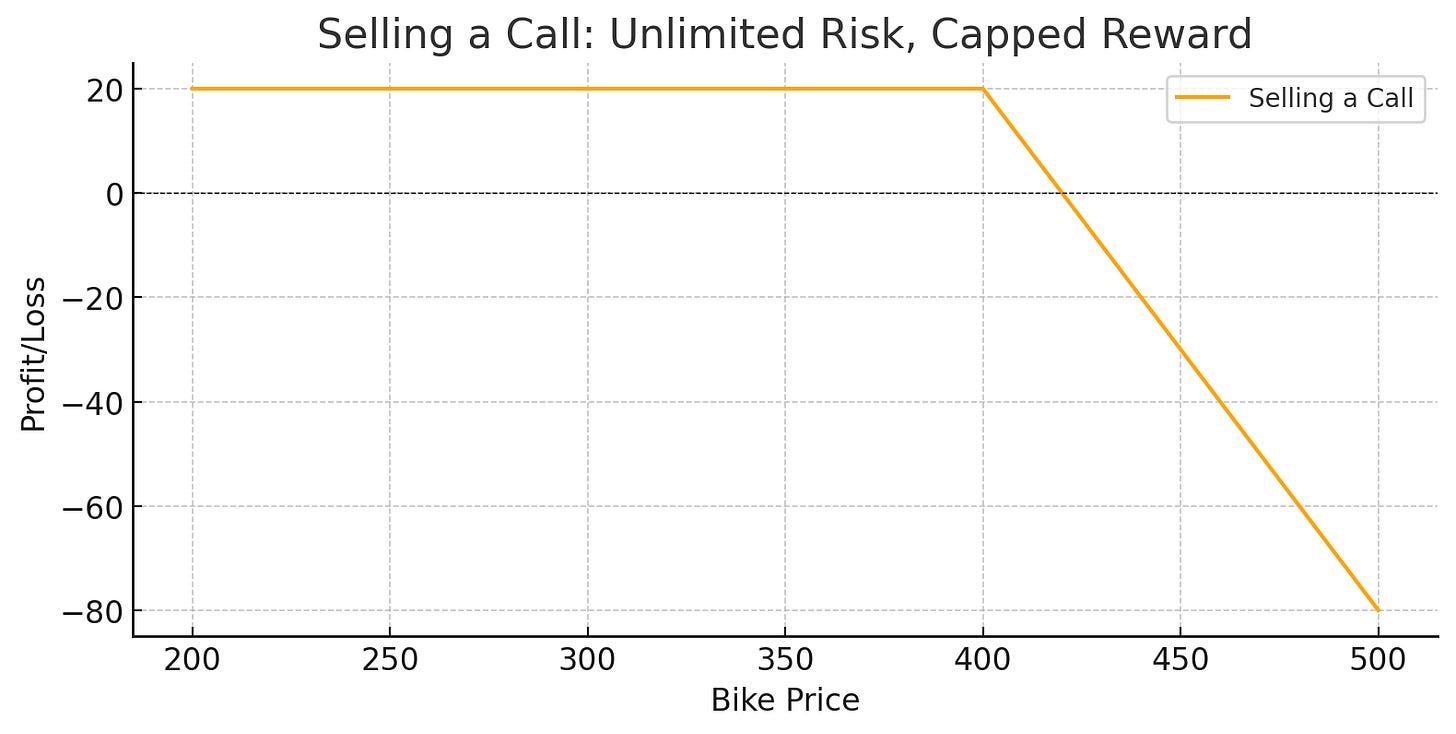

Selling a Call: Earning Money by Offering Others a Chance

Let’s flip the script: instead of buying an option, imagine you already own bikes or expect prices to remain steady and not rise significantly beyond a certain point. You can earn extra income by selling a call option.

Here’s the deal: you sell the right to another company for $20 per bike to buy 10 bikes from you at $400 (Strike price) each within the next week. Why? You believe prices won’t rise much higher than $400, making this an easy way to pocket some cash upfront.

Think of it this way: if bike prices stay below $400, the other company won’t exercise their option. You keep the $20 premium per bike, earning $200 total with no additional effort.

This works if you expect the market to stay stable or rise slightly. If the bike prices stay below $400, the buyer won’t exercise their option, and you’ll pocket the $200 total premium without doing anything else. However, there’s a catch: if bike prices rise above $400, you’re obligated to sell the bikes at the strike price, even if their market value is much higher. This means your potential losses are unlimited because there’s no ceiling on how high bike prices can go.

For example, if bike prices hit $450, you’ll sell the bikes for $400, meaning you have to sell the bikes at $50 below market price. If prices climb further to $500, your loss increases, as you’re still required to sell at $400, regardless of the higher market price. This is what makes selling a call option risky—your downside is theoretically unlimited.

Here you can also see, that if the prices of the bikes rise, you are at the loss of the price difference. And this is what makes selling options so dangerous. Initially, you will receive the option price money and you will instantly be in profit with an amount equal to the option price. But you also have unlimited risk. Once the price of a bike rises to $420 you are at breakeven (that is 0 on the chart) and then from there on you are at a loss for any further upside that the prices can have. In summary, let’s have a look at the risk and reward.

Risk and Reward:

Risk is unlimited: If bike prices rise above $400 (e.g., to $450, $500, or higher), you’re forced to sell the bikes at $400, even if the market price is much higher. For example:

Your risk is unlimited: If prices rise significantly above $400, your losses grow with every dollar increase. For example:

If the price of a bike goes to $500: Loss = Strike Price - Premium + Price = ($400 - $500 + $20) × 10 = -$800.

Reward is capped: You keep the premium received ($200 total for 10 bikes) no matter what happens. If prices stay below $400, the buyer doesn’t exercise the option, and you keep the premium as profit.

Summary: You earn a small, fixed premium upfront, but you take on unlimited risk if prices rise significantly.

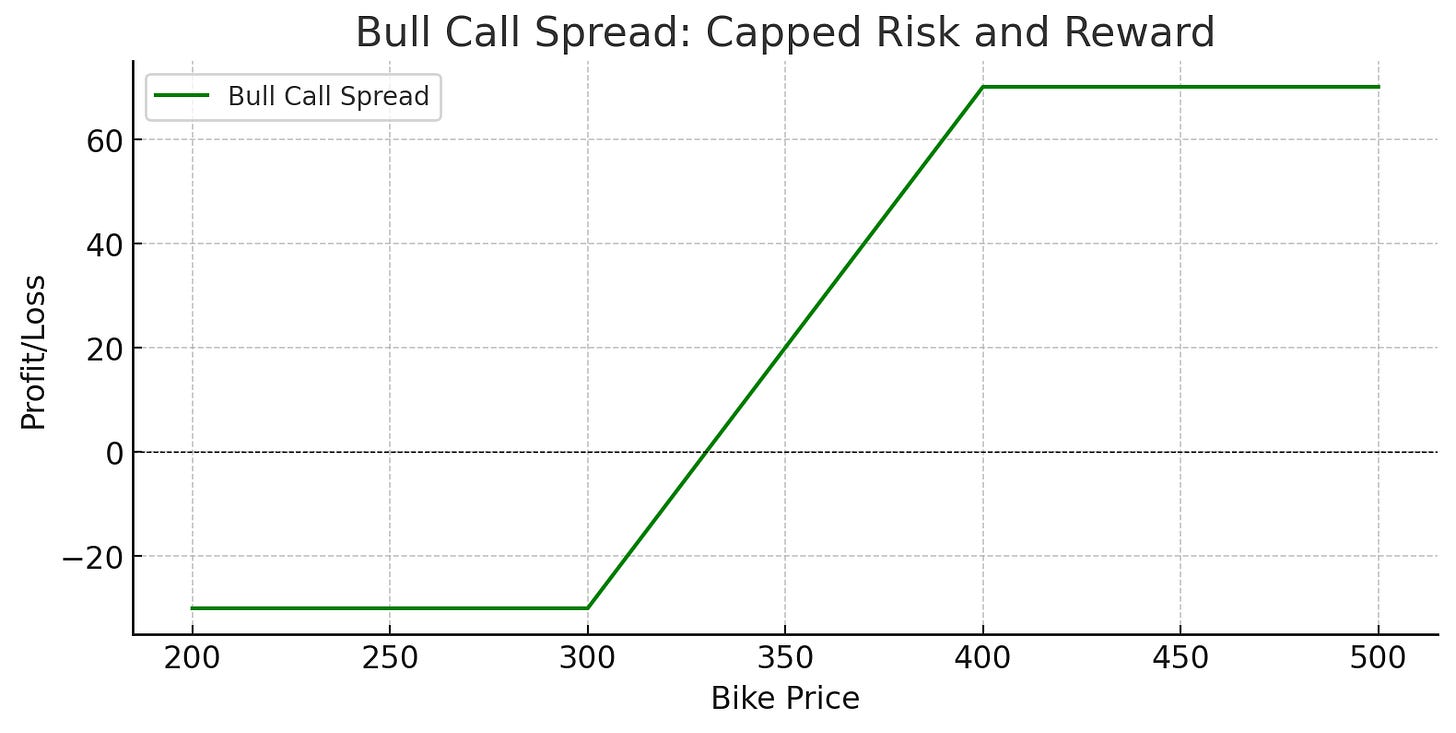

Bull Call Spread: Combining Buying and Selling for Balanced Risk and Reward

Now, let’s say you want a middle ground. You think prices will rise moderately, but you don’t want to risk too much or pay a high premium. This is where the bull call spread comes in—it’s a combination of buying a call and selling a call.

You believe the price of bikes will go up to $450 or $500. But you want to limit your risk and spend less on the cost of an option.

Here’s the deal: you pay $50 per bike to buy a call at $300 (Strike price) for 10 bikes. At the same time, you sell a call to another company for $20 per bike, giving them the right to buy the bikes from you at $400 (Strike price). By doing this, you lower your upfront cost to $30 per bike while capping both your risks and rewards.

Think of it this way: if bike prices stay below $300, you lose the net premium of $30 per bike, or $300 total for 10 bikes. If prices rise to $400 or more, you maximize your profit by buying the bikes at $300 and selling them at $400. Your upside is capped, but so is your downside.

Let’s look at the chart. Initially, you’re at a loss of $300 (the net premium). Once prices rise to $330, you break even. Beyond that, your profits grow until they hit the cap at $400, where you stop gaining further. If prices rise above $400, the additional gains are passed on to the buyer of your second call option.

Risk and Reward:

Risk is capped: The maximum loss is the net cost of the premiums paid ($30 per bike, or $300 total for 10 bikes). This happens if prices stay below $300, where neither option is exercised.

Reward is capped: The maximum profit occurs when bike prices rise to $400 or higher. Your profit is the difference between the two strike prices ($100 per bike) minus the net cost of the premiums ($30 per bike):

If the price of a bike goes to $380: Profit = (Price – Strike - Premium) = ($380 - $300 - $30) × 10 = $500 total.

Maximum profit = ($400 - $300 - $30) × 10 = $700 total.

Summary: Both risk and reward are capped. You trade off unlimited upside for reduced costs and lower risk.

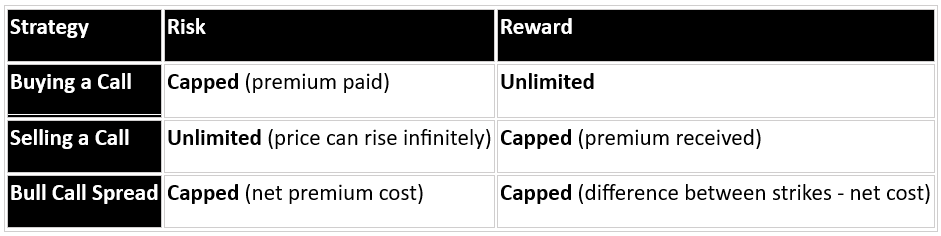

Comparison of Risks and Rewards:

Summary

In this blog, we explored three powerful options trading strategies—buying a call, selling a call, and the bull call spread—using a relatable example of bike rentals to break down the concepts. Here’s a quick recap:

Buying a Call allows you to profit from price increases with limited risk. It’s a great strategy if you’re bullish on the market and want unlimited upside potential.

Selling a Call generates income upfront but comes with unlimited risk if prices rise significantly, making it suitable for stable or slightly bearish markets.

The Bull Call Spread balances risk and reward by combining buying and selling calls, reducing upfront costs while capping both potential profits and losses. It’s ideal for cautiously optimistic traders expecting moderate price increases.

Options trading offers a versatile way to navigate the crypto market, whether you’re looking to maximize returns, generate income, or manage risk effectively.

🐋 Swim with the Whales

In the Whale Room, where precision meets profit, our trading legends are making waves yet again with their outstanding calls. Christo Columbus continues to showcase his sharp instincts, with his Grok trade now standing at a jaw-dropping 1,400% gain. Adding to his stellar track record, Christo’s call on XRP recently delivered an impressive 185% return, further cementing his reputation as one of the best in the business.

Meanwhile, Farouk the Sea-Scalper once again demonstrated his mastery of timing the market. He led the community to catch ETH at what he described as a “PICO bottom.” This strategic entry is expected to yield a remarkable 108% gain or more, and the room is now watching closely as we aim to break new all-time highs.

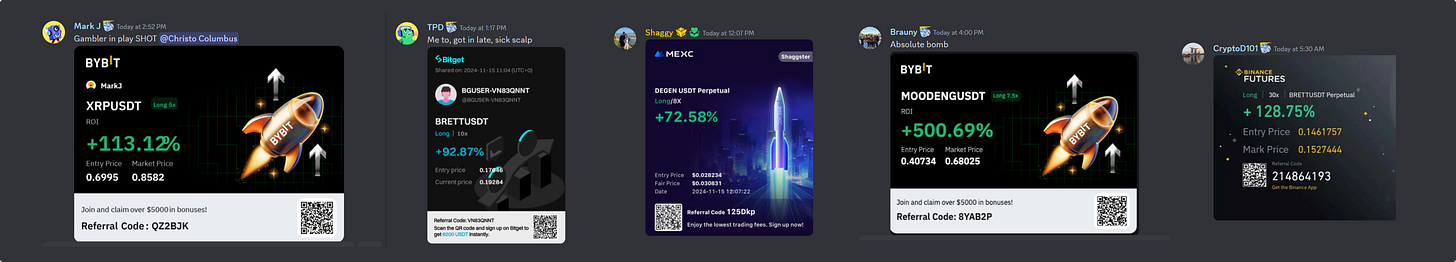

Some of our members’ results:

In the Whale Room, these trading icons aren’t just delivering results—they’re empowering members with insights and strategies to consistently succeed in the market. This is where traders grow, thrive, and win together.

💡 Ready to ride the wave of success? Join the Whale Room today and start swimming with the whales! Sign up here.

🔥Conclusion

Options trading might seem complex, but when broken down into everyday examples, the strategies become much easier to grasp. Whether you’re bullish and want unlimited upside with a call, looking for income with a sold call, or balancing risk and reward with a bull call spread, these tools can help you navigate the market with precision.

The key to success lies in understanding your goals, assessing the risks, and applying the right strategy at the right time. With options, you have the flexibility to profit in various market conditions—whether prices rise, fall, or stay steady.

Ready to Level Up Your Trading?

These strategies are just the beginning. At The Whale Room, you’ll gain access to a community of experienced traders, institutional-grade insights, and exclusive trading signals that help you apply these strategies in real-time. Whether you’re a beginner or an advanced trader, our resources and live sessions can elevate your trading game.

💡 Don’t miss out on your chance to join the top trading community! Click here to dive into the Whale Room and start trading like a pro.

Help Spread the Word!

If you’d like to help me spread the word, all you have to do is send one friend a personal email where you tell them all about today’s blog.

Follow Kyle on X: Kyle Doops

Watch Kyle’s YouTube channel: Kyle's YouTube

Follow us on our new Whale Room page X page here.

Chat soon!