TRADE LIVE WITH KYLE SOON: Alright, Whale Room fam, mark your calendars! This Saturday, Kyle will be live on YouTube channel, showing you exactly how he plans to turn a modest $229 into a $1171 profit. Yep, you read that right! For just a fraction of the cost of SOL, you can trade big right alongside the whales!

Missed his last live trade? Let me catch you up. On October 26, Kyle went live with an ETH trade and it was a HUGE success! This trade is already up by a whopping $1000, and it’s still going strong. If you missed out, don’t sweat it—this Saturday is your golden opportunity to catch Kyle live again and trade with him step-by-step.

In case you’re new to options or need a refresher, I’ve written an in-depth blog post where I break down how to trade options. This post builds on that blog, so definitely check it out if you’re looking to brush up.

And seriously, this is an incredible opportunity to see gains without needing the cash to buy 10 SOL outright. For less than a tenth of the cost, you’ll be able to trade with the big leagues!

To join in, make sure you’re fully prepped:

To jump in on the action, make sure you’re all set with these quick steps:

Sign up on Deribit if you haven’t already.

Join Kyle’s BANTER WHALE team for Deribit’s Winter Trading Competition 2024—there’s a juicy prize pool of up to 200,000 USDC on the line!

Connect to the Deribit API to SignalPlus, and you’re good to go.

The Plan: Trade SOL on Saturday!

Let’s break it down—Saturday’s trade target is SOL, but let’s first talk about the ETH trade that set the bar so high.

Why Was the ETH Trade So Great?

Let’s take a moment to recap our previous ETH trade—October 26 was quite a day! This trade has turned into a big win, with those who joined already seeing gains of $1000.

Here’s how we made that happen:

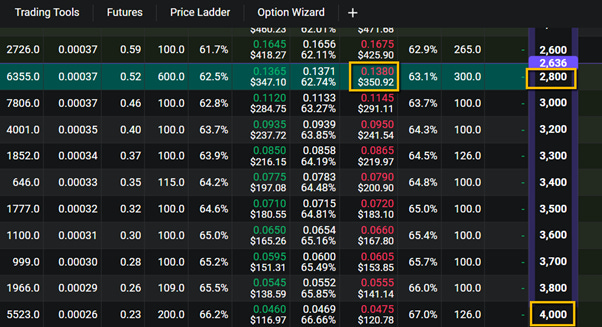

“Right now, ETH is trading at $2636. I am selecting a strike price of $2800. It can be more than $2636 or less than $2636. But for the sake of simplicity, select this for now. Because I believe ETH will be going up, I will take a CALL OPTION. The price of the option has an ASKING PRICE of $350.92 or 0.138 ETH, and the option expires on 28 March 2025. I expect ETH to be above $4000 by then.”

In this case, our call option was priced at $350, and those who jumped in are now up by $1000!

Understanding Why This Trade Worked

Let’s dive into the details of our ETH trade from October 26 to see why this setup was such a winner. First, here’s what I said when we entered the trade:

“Right now, ETH is trading at $2636. I am selecting a strike price of $2800. It can be more than $2636 or less than $2636. But for the sake of simplicity, select this for now. Because I believe ETH will be going up, I will take a CALL OPTION. The price of the option has an ASKING PRICE of $350.92 or 0.138 ETH, and the option expires on 28 March 2025. I expect ETH to be above $4000 by then.”

Here’s How It Played Out

To help visualize why this trade worked, let’s look at three key charts:

Initial Option Purchase Price: When we bought the call option two weeks ago, the option’s asking price was $350. At this point, we were anticipating ETH would rise and took a call option with a March 2025 expiration. The setup was based on a solid estimation of ETH’s price direction and timing.

2. Option Value After Two Weeks (November 13): Fast forward two weeks, and ETH’s option price has jumped to $491. Compare that to the $350 price from just two weeks ago! This price increase is due to several factors: ETH’s price has risen, demand has grown, and volatility has also spiked.

Option Value Projection (September 2025): If we choose to hold this option until September 26, 2025, the option’s value then reaches $717. Why? The longer the time until expiration, the higher the potential for volatility, which in turn increases the option’s price.

How Pricing Factors in with the Black-Scholes-Merton Model

To understand how these values are determined, most platforms rely on the Black-Scholes-Merton Model. This model calculates a fair price for call and put options by factoring in:

How Volatility Boosted Our Gains

At the time of our entry, ETH’s volatility was low, which kept the option’s initial price accessible. As ETH’s price rose to $3600, volatility increased, amplifying our profit. For context, crypto assets like Bitcoin often have implied volatility in the range of 60-100% in stable markets, with the potential to exceed 150-200% in extreme conditions.

In short, this ETH trade was perfectly timed for an optimal outcome: minimal holding time, low initial volatility, and a well-timed entry at the end of a range. That’s what makes this setup such a winner!

Planning our SOLANA Trade

Alright, Whale Room crew—today we’re shifting focus to Solana (SOL). Let’s map out our strategy.

In the ETH trade, we used ETH as our base currency. This time, with SOL, our trade will be based on USDC as the quote currency, allowing us to make gains directly in a stablecoin. The approach is similar, but we’re fine-tuning it for SOL’s unique market dynamics.

The Game Plan

I believe SOL will trade at around $400 by the end of December. With that target in mind, we’ll use an options strategy to capitalize on this expected price rise.

Here’s how we’re structuring the SOL trade:

Current Price of SOL: $215

Target Price: $400 by the end of December

Trade Strategy: Call option with USDC as the quote currency

By selecting this setup, we’re positioning ourselves to benefit from any upward movement in SOL, with minimized risk compared to buying outright. Let’s dive into the strategy details with specific strike prices and premiums in the next section.

Why is this a good trade?

If this trade plays out, you’re looking at a potential $1171 profit from just a $229 investment. That’s a 1:5 risk-to-reward ratio! For those who’ve been with us in the Whale Room for a while, you know we typically aim for a 1:3 risk-to-reward ratio, making this setup an exceptional opportunity. This is exactly the kind of high-reward trade we look for!

Bull Call Spread

A bull call spread is a vertical spread options strategy involving buying a call option at a lower strike price and selling another call option at a higher strike price both with the same expiration date. This strategy is used when you expect a moderate price increase in the underlying asset and want to limit your risk. It is less risky than just buying a call option outright.

How much would I make if am correct?

Price of SOL Between $220 and $360 – Say $300:

The $220 call will be in-the-money, and you will have a profit equal to the difference between the spot price and the strike price of $220.

The $360 call will remain out-of-the-money and expire worthless.

Profit Calculation: Suppose SOL is at $300:

Value of $220 call: $300 - $220 = $80.

Adding the net premium: $80 - $22.9 = $57.1. But for 10 SOL it will be $571

Price of SOL at Expiry is Above $360:

The maximum profit is realized when SOL is at or above $360.

Profit Calculation:

The value of the spread is the difference between the two strike prices, which is $360 - $220 = $140.

Adding the net premium: $140 - $22.9= $117.1.

Maximum Profit: $117.1. But for 10 SOL it will be $1171

How much would I lose if I am WRONG?

Price of SOL at Expiry is below $220:

Both options will expire worthless since the price is below both strike prices.

Profit/Loss: - $22.9. But for 10 SOL it will be a loss of $229

Why Use a Bull Call Spread?

The bull call spread allows you to limit risk while profiting from a moderate rise in the price of SOL.

The net credit means you immediately receive money upfront, reducing the cost of the trade.

The profit is capped because of the call sold at $360, but the maximum risk is also limited since the lower strike call helps offset any potential losses.

There You Have It, Fellow Traders!

This is how we’re maximizing gains with minimal input and risk. Today’s SOL trade is just another example of how to make smart moves without going all in.

Coming Up Next…

In my next blog, we’re going to dive into something crucial for anyone serious about options: selling options. This can be highly profitable, but there’s a catch—it can also be extremely risky if you’re not fully prepared. I’ll break down exactly when it makes sense to sell a call and, more importantly, when it’s very dangerous.

Don’t miss this one! It’s going to be packed with the critical insights you’ll need if you’re ready to step up your game in options trading.

🐋 Swim with the Whales

In the Whale Room, where precision meets profit, our trading legends continue to make waves with their remarkable calls. Here’s how they’re dominating the market this week:

Christo Columbus – Golden Gains Galore

Christo’s sharp eye for opportunity never fails. His Grok trade now stands at an incredible 1,400% gain, and he’s keeping up the momentum with a 900% return on RENDER. His knack for spotting golden setups continues to inspire everyone in the Whale Room.

Farouk the Sea-Scalper – Master of the “Pico Bottom”

After a recent sell-off, Farouk led the community to catch ETH at what he called a “pico bottom.” Now we’re hoping to break ATH at 108% with this one! Farouk’s skill at timing the market keeps the room excited and ready for more.

In the Whale Room, these traders are delivering win after win, guiding members to success with each call.

⭐️ Whale stories

Let’s hear from the community! Our Whale Room member phitt4024 said it best:

“I have been in crypto for a while now and been part of many paid groups offering signals, set ups and trainings. In all honesty i joined the Whale Room by using a monthly promotion thinking I would just make the most out of it that month and then leave. It has been almost 4 months now and i am hooked. The level of analysis, calls, training and support is amazing. It is so clear that the whole team is committed to our learning and success. The lengthy discord calls, the regularly scheduled Zooms and every interaction with the team gives me invaluable learnings. Kudos to the team, especially Kyle, Chris and Farouk. Pity I did not join before, but so gratetul I finally joined. Many thanks. Pablo H”

🔥 Conclusion

So there you have it, fellow traders! We’re all about maximizing gains with minimal input and risk, and today’s SOL trade is another solid example of how to trade smart without going all in.

Now, I want to hear from you! Drop a comment below to let me know if you will attend Kyle’s live trade on Saturday. Did my post today help you prepare for the event this coming Saturday? Let’s share those wins!

Better still, join us in the Whale Room for guidance, community support, education, and all those trades that fall from the sky.

Help Spread the Word!

If you’d like to help me spread the word, all you have to do is send one friend a personal email where you tell them all about today’s blog.

Follow Kyle on X: Kyle Doops

Watch Kyle’s YouTube channel: Kyle's YouTube

Follow us on our new Whale Room page X page here.

Chat soon!